Taxpayers Will Not Be Paying to Build the Ark Encounter

It’s regrettable that some journalists, intentionally or not, have left readers and viewers with a totally wrong impression about the state’s involvement with the Ark Encounter.

[Editor’s Note: This article has been updated as of February 16, 2012, to reflect the current status of the Ark Encounter project.]

I am a creationist, through and through. The issue is what brought me to belief. However much I love dabbling in the issue, I do not think AiG should be using taxpayer money to fund the Ark Park. It is a violation of church and state. ...

– G. C.

It is always wonderful to hear such testimonies. Thank you. The Bible’s veracity is increasingly under attack today, and people are less inclined to listen to its teachings because they see the Book as untrustworthy.

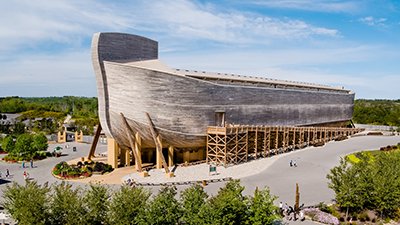

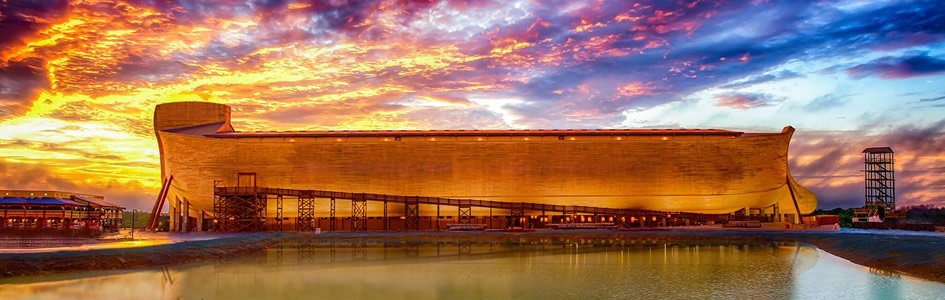

Media outlets and bloggers worldwide have been reporting on our plan to partner with Ark Encounter LLC to build a Noah’s Ark themed attraction (with a full-scale wooden Ark, built to the biblical dimensions) in northern Kentucky and about 40 miles from our Creation Museum. However, many of them are misrepresenting the funding and nature of the project.

An occasional AiG supporter (like G.C. above) has become confused by the news (and blog) coverage and has asked us about the Ark Encounter funding. While tax incentives are being applied for by the for-profit Ark Encounter LLC, it’s regrettable that some journalists, intentionally or not, have left readers and viewers with a totally wrong impression about the state’s involvement, falsely reporting that the Ark project will be a drain on state revenues. No funds will be taken from the Kentucky state budget and away from state programs (e.g., social services, schools, etc.) to help operate the Ark Encounter before or after it opens.

On the contrary, and as we will show below, the state will see added revenue because of the Ark Encounter’s possible presence in Kentucky.

Also, we must point out that the tax incentives do not go to non-profit AiG, but to the for-profit Ark Encounter LLC.

Sadly, these pieces of crucial information are often not mentioned by the press or bloggers.

Here is what will really happen if the state approves tax incentives for the Ark Encounter LLC.

First, AiG is not receiving any taxpayer money to build the Ark Encounter. The Ark Encounter LLC has applied for the tax incentives, and even then, it does not receive tax incentives to build the Ark Encounter. The incentives would come into effect after the Ark Encounter opens and is based on performance. Second, the tax incentives involve rebated money. No money will be taken from the state budget. Even after Ark Encounter opens, no money will come from the state budget to operate the finished Ark Encounter.

What is involved here is that the Ark Encounter LLC is applying for tax incentives through the state’s Tourism Development Act (which is designed to help bring tourist-drawing projects) to receive refunds on sales tax the attraction has collected through ticket sales, concessions, etc. This is in the form of rebates and will come after the Ark Encounter meets certain performance-based figures. But any rebated money does not come from the state budget. By the way, over 80% of the sales revenue will be generated by out-of-state visitors.

Some people in the media and blogosphere apparently don’t want you to know that the Ark Encounter will ultimately add millions of dollars to state coffers each year, not take away as is implied by some reports. Furthermore, it will be a tremendous job generator. This revenue-generating project not only will see the state gain financially through additional sales tax, but also through new employees hired at the attraction and at new businesses that will be created through the ripple effects generated by the opening of the Ark Encounter. Because the Ark will lead to the creation of several thousand jobs (at the Ark Encounter and new businesses created as a result of the Ark’s effect), these new job-holders will also pay payroll taxes, real estate taxes, etc.

On top of the millions of dollars that the state will keep in sales tax from the Ark Encounter, the project will generate city and county real estate taxes. Combined, the sales tax collected plus other taxes will generate millions of dollars of new revenue each year to state and local governments, which would not have been available, of course, if there were no Ark Encounter. That is why the Tourism Development Act was designed in the first place. Ultimately, the Ark Encounter is revenue positive for the state, not a drain; some critics do not want to tell you that.

Furthermore, Kentucky Governor Steve Beshear has pointed out to reporters that his legal advisors determined that the Ark Encounter qualifies to benefit from tax incentives provided by the state’s Tourism Development Act, which is designed to bring tourist attractions to Kentucky. The governor observed at his December 1 news conference (where he announced the Ark Encounter) that the Act does not discriminate according to the subject matter of a theme park; thus there is no constitutional problem, which even some of our most vocal critics, including a lawyer for a national atheist group, admit is probably the case.

Bottom line: the Ark Encounter will not, as some opponents imply, take money from the state budget. The Ark Encounter will actually add millions of dollars of sales tax (and from other related taxes) each year to the state. It will not take money from the state of Kentucky’s budget.

Many in the media and in blogs have lashed out at Governor Beshear for supposedly mixing church and state, relegating his pro-economy, pro-jobs stance to be of less importance than a concern over an alleged “separation of church and state” violation. At his December 1 press conference, Gov. Beshear declared that priority number one for him as governor is to build the economy in Kentucky and add jobs. The Ark project will add thousands of tourism-related jobs, and the region will see the construction of hotels, restaurants, retail establishments, gas stations, and other businesses. The Governor even noted that there will also be several hundred jobs created during the construction of the Ark before it opens.

A future approval of the Ark Encounter LLC’s tax incentive application would not be a violation of separation of church and state and the Consitution’s establishment clause. Gov. Beshear has made that clear in two meetings with the press. The Tourism Development Act in Kentucky is nondiscriminatory. Virtually any tourist attraction can apply for incentives regardless of message. If a Jewish group wanted to build an Old Testament-themed attraction, it can apply for a tax incentive. The nondiscriminatory aspect of the Act was even acknowledged by Bill Sharp of the American Civil Liberties Union (ACLU) of Kentucky when he told USA Today (December 5) that “courts have found that giving such tax exemptions on a nondiscriminatory basis does not violate the establishment clause, even when the tax exemption goes to a religious purpose.”

It appears that many of Gov. Beshear’s critics are far more concerned about the governor supporting tax incentives for an attraction that features elements from the Old Testament than they are about the unemployed (10% unemployment in the state) and a cash-strapped state that is desperately seeking additional revenue to balance its budget and provide needed services. Attacks on the Ark Encounter project only help to reveal the nature of many Ark detractors, who are so set in their beliefs that they will not even consider how this family-friendly and economically sound attraction will be a great asset to the state during a difficult economic time. Such bias seems to have clouded some reporting and has misled readers/viewers about how the Ark Encounter will really be funded. Private investors will fund the Ark Encounter’s construction and operation. Perhaps commentators don’t care that using such scare tactics might push the project—and millions of dollars in tax revenue and thousands of jobs—off to another state. For a cash-strapped Kentucky with high unemployment, that would be sheer economic folly.

Yet that may be the price that some Ark Encounter critics are willing to pay in order to advance their agenda. They apparently do not really care that so many people are unemployed, and that the state is cutting back on services to needy people because of a lack of state revenue.

Thank you for your question.

Sincerely,

Mark Looy

Recommended Resources

Answers in Genesis is an apologetics ministry, dedicated to helping Christians defend their faith and proclaim the good news of Jesus Christ.

- Customer Service 800.778.3390

- Available Monday–Friday | 9 AM–5 PM ET

- © 2026 Answers in Genesis